- Company: Baxter International, Baxalta

- Ticker: BAX, BXLT

- Market Cap: $24.8bn

- Size of Action: ~$420mm

- Type of Transaction: Split-off Transaction w/ Odd-Lot Provision + Merger Arbitrage

-

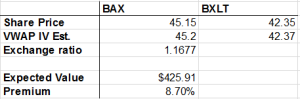

- Potential Gain (%): 8.7% from the split-off transaction then a further 4.2% from a merger arbitrage situation

- Expiration: May 18th, 2016 for the split-off transaction

- Tender Limit (Shares): 99

- Max Investment ($): ~$4,500 per account

- Max Gain ($): ~$600 per account

- Sec Filing: Link

- Summary: Baxter (BAX) is splitting off the remaining shares (12.8mm) it owns of Baxalta (BXWT) by May 18th. For each $100 of BAX stock, shareholders who choose to tender will receive $107.52 shares of BWXT subject to a upper limit of 1.4026. For the latest exchange ratio you can check http://www.dfking.com/bax/. Shareholders pay have to call their broker and specifically request preferential odd-lot treatment. Furthermore, after this transaction, BWXT is planning to merge with Shire (SHPG). Baxalta (BXLT) shareholders are set to vote on the deal on May 27, and Shire’s (SHPG) on June 3. Shire's offer is $18 in cash and 0.1482 shares of Shire which currently translate to $44.15 per share of BWXT (which currently trades at $42.35). If owners of BAX decide to both receive BWXT shares in the split-off and then hold shares until the merger between BWXT and SHPG is complete - they will make roughly $592 on their investment of $4469 - a return of 14% within a month (pending how long the merger takes to close). The merger is subject to regulatory approval and is not as certain as the split-off transaction. Invest at your own risk.

- Odd Lot Provision: ..If you directly or beneficially own less than 100 shares of Baxter common stock and wish to tender all of your shares of Baxter common stock, you may request that your shares not be subject to proration. In order to request this preferential treatment, you should check the box under “Proration/Odd Lot” on the letter of transmittal. If your odd-lot shares are held by a broker, dealer, commercial bank, trust company, custodian or similar institution for your account, you should contact that institution so that it can request such preferential treatment. ....

- All information contained on or available through this Web Site (“the Content”) is for general information purposes only and does not constitute any investment advice.

Subscribe Here for Active Ideas

Contact

-

Recent Posts

Archives

- October 2018

- September 2018

- January 2018

- October 2017

- September 2017

- July 2017

- June 2017

- May 2017

- April 2017

- December 2016

- November 2016

- October 2016

- September 2016

- July 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- May 2013

Categories